Why a Fed Rate Cut Won’t Quickly Change Today’s Housing Market (And What It Means for You)

Why a Fed Rate Cut Won’t Quickly Change Today’s Housing Market (And What It Means for You)

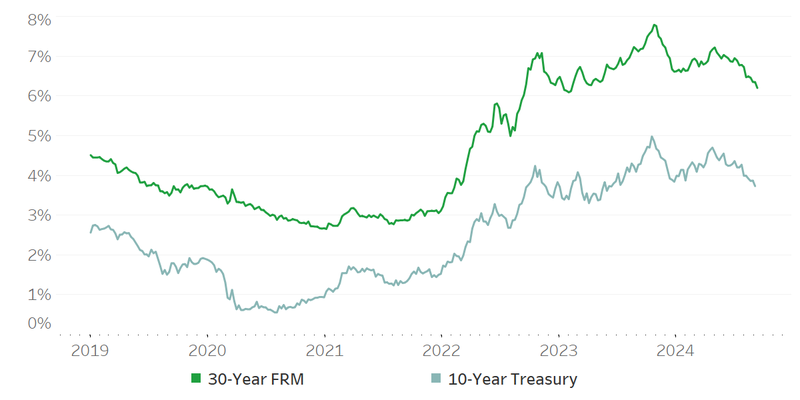

As the Federal Reserve gears up for another meeting, there’s a lot of buzz—especially with mortgage rates lingering near 6.8% for what feels like an eternity. The President is turning up the heat on the Fed Chair to lower rates, but even if a rate cut comes this week, don’t expect the housing market to do a sudden about-face.

As the Federal Reserve gears up for another meeting, there’s a lot of buzz—especially with mortgage rates lingering near 6.8% for what feels like an eternity. The President is turning up the heat on the Fed Chair to lower rates, but even if a rate cut comes this week, don’t expect the housing market to do a sudden about-face.

Here’s what’s really going on: New listings dropped 3.2% in June, marking the biggest dip since early 2023. Pending sales also slipped 2.2% month-over-month. While inventory is technically up 13.3% from last year, that’s mostly because buyers are sitting on the sidelines—not because there’s a flood of new homes hitting the market. Meanwhile, home prices soared to a record $447,035 in June, but annual price growth has cooled to just 1%. That’s a clear sign sellers’ pricing power is starting to fade.

What Does This Mean for You?

- For Buyers: If you’ve been waiting for rates to drop before jumping in, patience is key. Even if the Fed cuts rates, mortgage rates may only move gradually. With prices stabilizing and more inventory than last year, you might find less competition—but don’t expect a dramatic dip in prices overnight. Keep your finances ready and watch for motivated sellers, especially as the market cools.

- For Sellers: The days of double-digit price jumps are behind us—for now. With demand softening, pricing your home realistically is more important than ever. Homes are selling, but buyers are choosier, so highlight what makes your property stand out. If you’re thinking about listing, be prepared for a longer time on market and consider incentives to attract buyers.

- For First-Time Buyers: This market can feel daunting, but there’s a silver lining: less competition and more choices than last year. Don’t rush, but also don’t wait for the “perfect” rate cut. Focus on finding a home that fits your needs and budget, and be ready to act when you spot a good opportunity. Remember, you can always refinance if rates drop significantly in the future.

In short, while everyone’s watching the Fed, it’ll take more than a single rate cut to shake up the housing market. Stay informed, stay flexible, and remember: every market presents opportunities, no matter the headlines.

Categories

Recent Posts

Agent | License ID: 40693934-MN | 94076-WI

+1(612) 208-3859 | brian@brianleneweaver.homes